The Lifesaver of Bridge Financing: How BC Residents Can Benefit from Short-Term Solutions

- admin

- 0

- Posted on

Bridge financing has become a lifesaver for residents in British Columbia, providing a significant solution to financial difficulties. Nowadays, in the fast-paced real estate market, time is of the essence. This way, bridge financing offers homeowners and property investors a lifeline, ensuring seamless transitions between properties.

This short-term financial solution has gained significant traction among BC residents due to its benefits. This has made it a crucial tool for navigating the intricate landscape of real estate transactions.

Understanding Bridge Financing

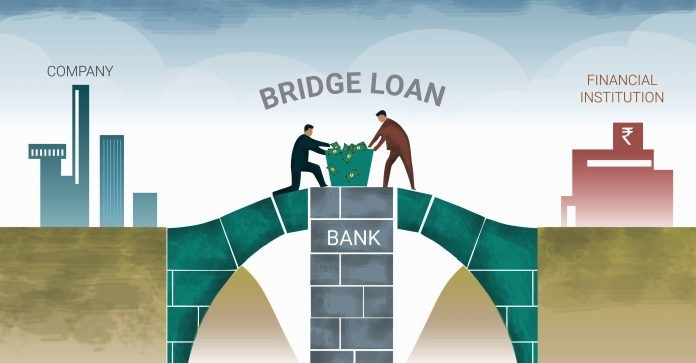

Bridge financing is a short-term loan that aids in bridging the gap between the purchase of a new property and selling an existing home. This financial tool acts as a bridge, allowing homeowners to get funds quickly and efficiently, even when their assets are tied up in the selling process. In the bustling real estate market of British Columbia, where timing is often of the essence, bridge financing has become a vital instrument for homeowners and investors alike.

How can residents benefit?

1. Swift and Hassle-Free Property Transactions

One of the critical benefits of bridge financing for British Columbia residents is its ability to facilitate swift and hassle-free property transactions. In a competitive market, opportunities come and go, but private lenders offer bridge loans, which empower individuals to act quickly.

By bridging the gap between selling an existing property and purchasing a new one, residents can seize deals without difficulty. This agility ensures timely acquisitions and opens doors to profitable investment prospects that might otherwise slip away.

2. Flexibility in Repayment Terms

Bridge home equity loans in BC provide unparalleled flexibility in repayment terms, catering to BC residents’ diverse requirements and financial situations. Unlike traditional loans, bridge loans are customized to match individual circumstances.

This allows borrowers to tailor their repayment schedule to their cash flow and income patterns. This adaptability minimizes financial strain on borrowers and provides breathing room, enabling them to focus on their property-related endeavors.

3. Mitigating Cash Flow Challenges

Managing cash flow during a home transition can be a lot of work for many BC residents. Bridge financing acts as a buffer, mitigating the challenges associated with cash flow fluctuations.

Whether bridging the gap between property sales or covering renovation costs before a property is put on the market, a bridge mortgage for foreclosure provides the necessary liquidity.

4. Strategic Investment chances

Beyond bridging the gap between property transactions, bridge financing opens avenues for strategic investment opportunities. BC residents can leverage a partial-interest loan to secure properties in prime locations or capitalize on emerging real estate trends.

Investors can diversify their portfolios by accessing short-term funds, capitalizing on market upswings, and maximizing their returns. This strategic approach to real estate investments amplifies financial gains and positions residents for long-term success in the competitive property market of British Columbia.

5. Navigating the Market with Confidence

The real estate market is affected by several effects, including economic conditions, family matters, and government policies. During periods of market uncertainty, having access to spousal buyout mortgages in Canada can offer a sense of security. Homeowners can leverage this tool to optimize their financial strategies by diversifying their investments or renovating their properties to enhance their market value.

Final thoughts

Bridge financing has emerged as the lifesaver of the British Columbia real estate market, offering a lifeline to residents seeking timely and efficient solutions. By embracing bridge loans’ flexibility and speed, BC residents can seize opportunities, address emergencies, and confidently navigate market fluctuations.