Category: Finance

Use Pedirayudas to stay informed about changing aid programs

Understanding the world of financial aid and scholarships can feel daunting. Programs evolve with new budgets, policies, and societal needs, making it challenging for individuals to keep track of the opportunities that could impact their education or livelihood. This is where Pedirayudas.com comes into play, acting as a vital tool to help people stay…

Read More

Top Tips for Successful CFD Trading: Avoiding Common Pitfalls

Trading CFDs, or Contracts for Difference, can be a thrilling and potentially lucrative venture, but it’s not without its risks. Like any form of trading, successful CFD trading requires a combination of knowledge, strategy, and discipline. Here are some top tips to help you avoid common pitfalls and navigate the world of CFD trading with…

Read More

Unlock Your Investment Future: Opening a Demat Account Online

Unlocking your investment future has never been more accessible or convenient than with the advent of online Demat accounts. Opening a Demat account online marks a significant shift in the landscape of investment, offering investors a streamlined and efficient way to participate in the financial markets. In this digital age, the traditional paperwork and cumbersome…

Read More

How can hybrid mutual funds hеlp invеstors bеnеfit from еquity and dеbt?

Invеsting your hard-еarnеd monеy wisеly is a goal sharеd by many in India. One way to achieve this goal is by еxploring the world of mutual funds. Whilе еquity and dеbt mutual funds еach offеr thеir own advantages and risks, have you еvеr wondеrеd if thеrе’s a way to bеnеfit from both? Entеr hybrid mutual…

Read More

Minimum amount due on credit card: What it is and why you should pay more

Paying only the minimum amount due on your credit card bill each month may seem like an easy option during financial constraints. However, this approach can lead you down a slippery slope of mounting interest costs, ballooning debt and damaged creditworthiness. Read on to find out more. What is the minimum amount due? The minimum…

Read More

Can taking out a personal loan improve your credit score?

Credit score is a critical factor that lenders consider when applying for a loan. Maintaining a good credit score opens up better borrowing opportunities and favourable interest rates. Did you know that a personal loan can improve your credit score? Read on to discover the hidden potential of personal loans and how they can pave…

Read More

Tips for keeping your current account safe

Your current account is a vital tool for managing your day-to-day finances. Hence, it’s essential to keep it safe from potential security threats. With the rise of net banking and digital transactions, it’s crucial to protect your current account and ensure that your hard-earned money is secure. Here are 6 tips for keeping your current…

Read More

Getting Started with Investing in Your 40s: Building a Strong Financial Future

While it’s true that starting early is advantageous in investing, it’s never too late to begin your journey towards building wealth and securing a stable financial future. Investing in your 40s may present unique challenges, but it also offers opportunities for growth and long-term financial success. In this article, we will explore the key considerations…

Read More

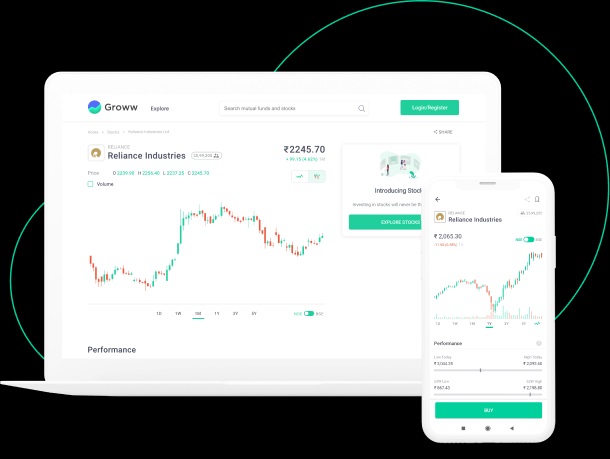

Zero Charges on Demat Account Opening: Start Trading Today

The demat account has become a must-have for anyone who wishes to invest and trade in the stock market. A demat account is a digital account that is used to hold securities and investments in a digital format. It provides investors with a secure and convenient way to hold their investments, without the need for…

Read More

Here’s how investing in debt funds can mitigate your mutual fund portfolio risk

Building your wealth through mutual fund investments can be challenging, with success relying heavily on proper risk management. Mutual funds allow you to invest your money in different stocks, bonds, and securities simultaneously, diversifying most of the risks associated with buying individual securities yourself – thus helping you grow your wealth. Although your portfolio needs…

Read More